Traveling can be an enriching experience, but it also comes with inherent risks, particularly concerning the safety of your money. Handling money safely while traveling is crucial to avoid theft, loss, or financial scams. This article will guide you through essential strategies to protect your finances throughout your journey, covering everything from pre-trip planning to on-the-ground tactics. Learn how to effectively manage your money, choose the right payment methods, and safeguard your financial information so you can enjoy your travels with peace of mind knowing your money is safe and secure. Whether you’re a seasoned globetrotter or planning your first international adventure, understanding how to handle money safely while traveling is a must.

From utilizing secure payment apps to understanding local currency exchange best practices, we’ll provide practical tips and advice to ensure your money remains safe and accessible throughout your travels. Discover the importance of notifying your bank of your travel plans, the benefits of carrying a mix of payment methods, and how to recognize and avoid common travel scams. By implementing these strategies, you can minimize the risks associated with handling money while traveling, allowing you to focus on creating unforgettable memories instead of worrying about financial issues. Implement these strategies and keep your travels safe and financially secure.

Using Credit Cards vs. Cash Abroad

Traveling internationally often requires careful consideration of how to manage finances. Using a credit card offers several advantages, including convenience and enhanced security features like fraud protection. Credit cards also often provide better exchange rates than currency exchange booths or airport kiosks. However, it’s essential to be mindful of foreign transaction fees, which can add up quickly. Additionally, not all establishments accept credit cards, particularly in smaller businesses or remote areas.

Carrying cash, on the other hand, can be useful for small purchases, tipping, and transactions in places where cards are not widely accepted. Having local currency readily available can avoid the hassle of finding ATMs and potentially paying withdrawal fees. However, carrying large amounts of cash poses a security risk in case of loss or theft. It’s generally advisable to carry a moderate amount of local currency and rely on ATMs for larger withdrawals.

Ultimately, the best approach is often a combination of both credit cards and cash. Using a credit card for larger purchases and hotel bookings while reserving cash for smaller transactions and places where cards aren’t accepted can provide a balanced and practical solution. Researching ATM fees and foreign transaction fees associated with your credit card before your trip can help you minimize costs and manage your finances effectively while abroad.

Avoiding Suspicious ATMs

Using an ATM safely requires vigilance. Inspect the ATM for any unusual attachments, such as card skimmers or hidden cameras. These devices are often crudely attached and may look out of place. If anything seems amiss, do not use the machine and report it to the bank or authorities. Additionally, be aware of your surroundings. If someone is standing too close or seems to be watching you, choose a different ATM or return later.

Shield your PIN when entering it. Use your hand or body to block the keypad from view, even if you think no one is watching. Skimming devices can sometimes be hidden in plain sight and criminals may be observing from a distance. Be wary of anyone attempting to distract you while you are using the ATM. Immediately retrieve your card and receipt after completing your transaction. Do not count or display your cash at the machine.

Whenever possible, choose ATMs located in secure, well-lit areas, such as inside banks or reputable businesses. These locations are typically monitored by security cameras and staff, deterring criminal activity. Avoid using ATMs in isolated or poorly lit locations, especially at night. If you experience any suspicious activity or have your card information stolen, contact your bank immediately to report the incident and take necessary precautions.

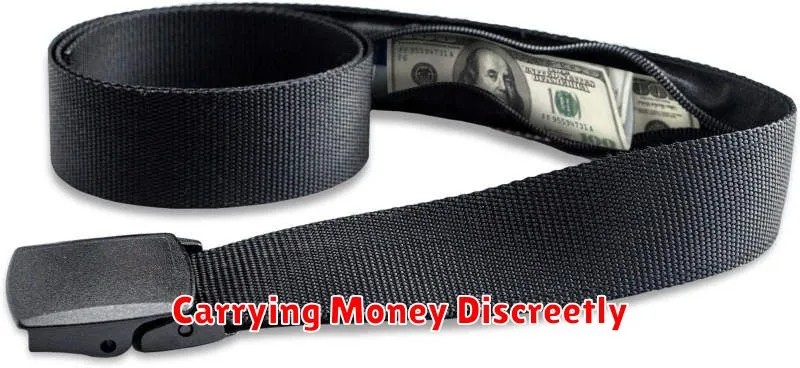

Carrying Money Discreetly

Safety and peace of mind are paramount when traveling or even just going about your daily routine. Carrying large sums of cash can make you a target for theft. Therefore, it’s crucial to be discreet about how you carry your money. Avoid flashing large wads of cash in public and opt for subtle methods instead.

Consider using a money belt or a neck pouch worn under your clothing. These are designed specifically to conceal currency and other valuables close to your body. Secret pockets within clothing or a small, nondescript wallet kept in a front pocket can also be effective. Divide your money between different locations, so if one stash is compromised, you don’t lose everything.

For added security, especially in crowded areas or while traveling, consider using a dummy wallet. This is a cheap wallet containing a small amount of cash and expired cards that can be handed over in the unlikely event of a robbery. Remember to always be aware of your surroundings and avoid drawing unnecessary attention to yourself.

Avoiding Public Currency Exchange Booths

Public currency exchange booths, often found in airports and tourist areas, are generally not recommended due to their unfavorable exchange rates. These booths capitalize on convenience, charging a premium for their services. This translates to receiving significantly less foreign currency than you would through more advantageous options. Planning ahead and obtaining currency through your bank or a reputable currency exchange service before your trip will result in a much better rate.

While the convenience of these booths might seem appealing, especially after a long flight, the hidden fees and markups quickly diminish any perceived benefit. Consider the amount you’ll lose over the course of your trip by accepting a poor exchange rate. Often, even using a credit card with foreign transaction fees is a more economical choice than these public booths.

Alternatives to these booths include ordering currency from your local bank, using a reputable online currency exchange service, or withdrawing cash from an ATM at your destination (be aware of ATM fees and your bank’s foreign transaction policies). These options typically provide much more competitive exchange rates and minimize fees, saving you money on your trip.

Keeping Emergency Funds Separate

Emergency funds are crucial for unexpected life events like job loss, medical emergencies, or urgent home repairs. Keeping this money separate from your regular spending accounts prevents accidental use and ensures it’s available when truly needed. Mingling these funds makes it tempting to dip in for non-emergencies, defeating the purpose of the safety net.

A separate account provides a clear picture of your financial stability in a crisis. It allows you to easily track your emergency savings progress and maintain the recommended 3-6 months of essential expenses. Consider a high-yield savings account or money market account for easy access and modest growth.

Separation also reinforces financial discipline. By establishing a dedicated emergency fund account, you create a psychological barrier against unnecessary spending. This conscious effort strengthens your overall financial habits and helps you build a secure financial future.

Using Mobile Payment Options Safely

Mobile payment options offer speed and convenience, but using them safely is crucial. Secure your device with a strong passcode, PIN, or biometric lock. Keep your software updated to patch security vulnerabilities. Only download payment apps from official app stores like Google Play or the Apple App Store. Be wary of using public Wi-Fi for transactions, as these networks can be vulnerable to hacking.

Protecting your financial information is paramount. Avoid storing sensitive data like credit card numbers directly on your device if possible. Utilize the security features provided by your mobile payment platform, such as tokenization, which replaces your card number with a unique, temporary code. Regularly monitor your transaction history for any unauthorized activity. If you lose your device, immediately contact your financial institution and mobile provider to suspend services and secure your accounts.

Be vigilant against phishing scams. Don’t click on suspicious links in emails or text messages that ask for your personal or financial information. Legitimate companies will never request such details through these channels. When making a mobile payment, ensure the merchant is reputable and that the transaction details are accurate before confirming. If anything seems unusual, cancel the transaction immediately. By following these precautions, you can confidently enjoy the benefits of mobile payments while minimizing the risks.

What to Do If You Lose Your Wallet

Losing your wallet can be a stressful experience, but taking swift action can minimize the damage. First, cancel your credit and debit cards. Contact your bank or financial institution immediately to report the loss and request replacements. This prevents unauthorized charges and protects you from potential fraud. Next, file a police report, even if you suspect it was simply misplaced. A police report can be helpful for insurance claims and identity theft protection. Finally, check your state’s Department of Motor Vehicles (DMV) website for instructions on replacing your driver’s license or other identification cards.

In addition to these immediate steps, consider taking proactive measures to safeguard yourself against future loss. This includes making a list of the contents of your wallet, including card numbers, expiration dates, and important contact information. Keep this list in a secure location separate from your wallet. You can also consider using digital wallet apps on your smartphone to store some of your essential cards and information. This can reduce your reliance on physical cards and minimize the impact of a lost wallet.

While taking these steps won’t eliminate the inconvenience of losing your wallet, it will help you mitigate the risks and regain control of your finances and identification. Remember to stay vigilant and take precautions to protect yourself from identity theft and financial loss.