Traveling can be an enriching and exciting experience, but unforeseen circumstances can quickly turn a dream vacation into a stressful ordeal. From lost luggage and flight cancellations to medical emergencies and unexpected trip interruptions, the potential for disruptions is real. Travel insurance acts as a crucial safety net, protecting you from financial losses and providing valuable assistance when you need it most. Choosing the right travel insurance policy, however, can be daunting. With so many options and varying levels of coverage, it’s essential to understand your needs and select a plan that adequately addresses them. This guide will provide you with the knowledge and tools you need to navigate the world of travel insurance, helping you choose the best travel insurance policy for your next adventure.

This comprehensive guide delves into the intricacies of travel insurance, offering practical advice on how to choose the right coverage for your specific travel needs. We’ll explore key factors to consider, including your destination, planned activities, pre-existing medical conditions, and budget. Understanding these factors will empower you to make informed decisions and select a travel insurance policy that offers the best coverage and peace of mind. Whether you’re planning a relaxing beach getaway, an adventurous backpacking trip, or a business trip abroad, this guide will help you choose the travel insurance that covers what you need, ensuring a worry-free and enjoyable travel experience.

What Travel Insurance Typically Covers

Travel insurance is designed to protect you against unforeseen circumstances that can disrupt your trips. Trip cancellations or interruptions due to illness, severe weather, or other covered reasons are typically reimbursed. It can also cover lost or stolen baggage, providing financial compensation for your belongings. Furthermore, many policies include emergency medical expenses, ensuring you receive necessary treatment while traveling abroad, sometimes even including medical evacuation if needed.

Other common coverages often incorporated into travel insurance policies include travel delays, offering reimbursement for accommodation and meals if your trip is significantly delayed. 24/7 travel assistance services are frequently provided, offering support and guidance for various travel-related issues, from lost passports to navigating unfamiliar locations. Some policies also cover rental car damage, providing protection against financial liability for accidents or damage to your rental vehicle.

It’s important to carefully review the specific terms and conditions of any travel insurance policy you consider, as coverage can vary widely. Pay close attention to exclusions, which are situations or events not covered by the policy. Understanding the details of your policy ensures you’re adequately protected and know what to expect in the event of an unforeseen circumstance.

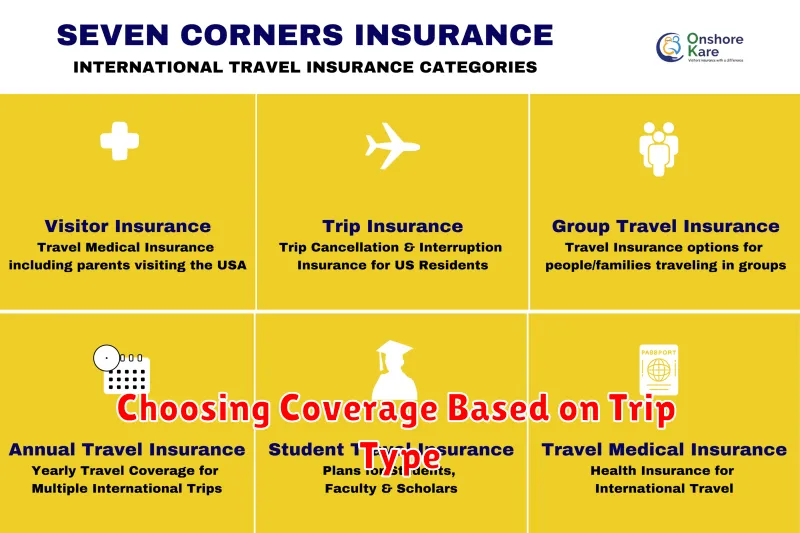

Different Types of Travel Insurance

Travel insurance offers crucial financial protection against unforeseen events that can disrupt your trips. Several types of travel insurance cater to different needs and budgets. Trip cancellation/interruption insurance is fundamental, covering non-refundable trip costs if you must cancel or cut your trip short due to covered reasons like illness, severe weather, or family emergencies. Medical travel insurance covers medical expenses incurred while traveling, which can be particularly important in destinations with expensive healthcare or where your domestic health insurance doesn’t provide coverage. Baggage insurance protects against lost, stolen, or damaged luggage and personal belongings.

Beyond these core types, more specialized options exist. Adventure travel insurance caters to activities like skiing, scuba diving, or mountain climbing. If you’re traveling frequently, an annual travel insurance policy provides ongoing coverage for multiple trips throughout the year. Consider cancel for any reason (CFAR) insurance for maximum flexibility, allowing you to cancel your trip for practically any reason, though it typically comes at a higher premium.

Choosing the right travel insurance depends on your individual trip and circumstances. Carefully evaluate your destination, activities planned, trip cost, and personal health considerations. Review policy details thoroughly to understand coverage limits, exclusions, and claim procedures before making a purchase. Protecting your travel investment with appropriate insurance ensures peace of mind and financial security should unexpected events occur.

Choosing Coverage Based on Trip Type

The type of trip you’re taking greatly influences the travel insurance coverage you’ll need. A simple domestic weekend getaway might only require basic coverage for lost luggage or trip interruptions. However, an international adventure trip involving extreme sports or a cruise to a remote location necessitates a more comprehensive policy that includes medical evacuation, emergency medical expenses, and coverage for specific activities.

Consider the destination and its associated risks. Traveling to a country with a different healthcare system than your own necessitates coverage for potential medical emergencies. Likewise, areas prone to natural disasters or political instability may require specialized coverage for trip cancellations or interruptions due to these unforeseen events. Carefully assess your itinerary and potential risks to choose the most appropriate coverage.

Finally, research the specific activities you’ll be participating in. Standard travel insurance policies might exclude coverage for high-risk activities like scuba diving, mountain climbing, or skiing. If your trip includes such activities, ensure your policy specifically covers them or consider purchasing a supplemental policy designed for adventure travel. Failing to obtain the correct coverage could leave you financially vulnerable in the event of an accident or emergency.

Top Providers in 2025

The landscape of service providers is constantly evolving. By 2025, key players are predicted to be those who prioritize innovation, customer experience, and sustainability. Companies leveraging advanced technologies like artificial intelligence, machine learning, and blockchain will be best positioned to meet the evolving demands of consumers and businesses.

Existing giants in technology and telecommunications are expected to remain dominant, though new entrants focusing on niche markets may disrupt specific sectors. Agility and the ability to adapt quickly to changing market conditions will be critical for success. This includes embracing new business models and prioritizing strategic partnerships.

Ultimately, the top providers of 2025 will be those who can deliver value. This encompasses not only competitive pricing but also exceptional service, personalized experiences, and a commitment to ethical and sustainable practices. Consumers will increasingly reward companies that align with their values.

Reading the Fine Print and Exclusions

Contracts, warranties, and insurance policies often contain fine print and exclusions that can significantly impact your rights and coverage. It’s crucial to read these sections carefully to understand what is and isn’t covered. Key terms to watch for include limitations, exclusions, waiting periods, and pre-existing conditions. Failing to understand these details can lead to unexpected costs and denied claims. Pay close attention to clauses that limit the company’s liability or require specific actions on your part to maintain coverage.

Some common exclusions found in insurance policies, for example, might include acts of war, natural disasters, or specific pre-existing medical conditions. Warranties may exclude damage caused by misuse or unauthorized repairs. Understanding these exclusions upfront can help you avoid disappointment and make informed decisions about purchasing additional coverage or taking preventative measures. Don’t hesitate to ask questions if anything is unclear.

Taking the time to thoroughly review the fine print and exclusions is a vital step in protecting your interests. If you find the language complex or confusing, seek professional advice from a lawyer or relevant expert. This small investment of time can save you significant trouble and expense in the future.

How to Compare Policies

Comparing policies effectively requires a structured approach. First, identify your needs. What are you hoping to achieve with this policy? What are your must-haves and deal-breakers? Once you have a clear understanding of your requirements, you can begin to evaluate different policies based on key criteria. These criteria could include coverage details, premiums, deductibles, exclusions, and the reputation of the provider.

Next, organize your findings. A side-by-side comparison chart can be very helpful. List each policy and its corresponding details for each criterion you’ve identified. This allows you to quickly see the strengths and weaknesses of each option. Pay close attention to the fine print and ensure you understand the implications of each policy’s terms and conditions. Don’t hesitate to contact providers directly to ask clarifying questions.

Finally, make an informed decision. Consider your budget, risk tolerance, and long-term goals. Weigh the costs and benefits of each policy based on your individual circumstances. Choosing the right policy involves careful consideration and due diligence. Remember that the cheapest policy isn’t always the best, and the most expensive doesn’t guarantee the most comprehensive coverage.

Filing a Claim Successfully

Filing a claim successfully requires careful preparation and attention to detail. Accurate documentation is crucial. This includes gathering all relevant paperwork such as receipts, invoices, contracts, and any supporting evidence that substantiates your claim. Clearly state the nature of your claim, providing specific dates, amounts, and a concise explanation of the circumstances. Thoroughly review all information before submission to ensure accuracy and avoid delays in processing.

Understanding the claim process is essential for a successful outcome. Familiarize yourself with the specific requirements and procedures of the entity handling your claim, whether it’s an insurance company, government agency, or other organization. Note any deadlines and adhere to them strictly. Maintain clear communication with the claims adjuster or representative, promptly responding to any inquiries and providing additional information as requested. This proactive approach can significantly expedite the process.

Finally, keep meticulous records of all communication and documentation related to your claim. This includes copies of submitted forms, correspondence, and any notes from conversations. Having a comprehensive record will not only help you stay organized but also prove invaluable should any discrepancies or disputes arise during the claim process. Remember, a well-documented and organized claim significantly increases the likelihood of a successful resolution.